Ladder Loans Review

In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving individuals in need of quick and reliable solutions. Ladder Loans step in as a viable option for those seeking short-term financial assistance. Established with the mission to provide accessible and transparent lending services, Ladder Loans aims to cater to the diverse needs of its customers.

Application Process

Applying for a loan with Ladder Loans is a straightforward process. Prospective borrowers can initiate the application online through the company’s website. The platform guides applicants through the necessary steps, ensuring a hassle-free experience. To qualify for a loan, individuals typically need to meet certain criteria, including age, income, and residency requirements.

Loan Options

Ladder Loans offers a variety of loan options to suit different financial situations. Whether individuals require a small cash advance or a larger sum for an unexpected expense, the company provides flexible solutions. Loan terms and conditions vary depending on the amount borrowed and the repayment period chosen by the borrower.

Interest Rates and Fees

Understanding the interest rates and associated fees is crucial for responsible borrowing. Ladder Loans strives to maintain transparency in its pricing structure, clearly outlining the applicable interest rates and any additional charges upfront. Borrowers should carefully review the terms of their loan agreement to avoid unexpected costs.

Repayment Plans

One of the standout features of Ladder Loans Review is its flexible repayment plans. Recognizing that financial circumstances can change, the company offers various options for managing loan payments. Whether borrowers prefer weekly, bi-weekly, or monthly installments, Ladder Loans accommodates diverse needs, helping individuals stay on track with their repayment schedule.

Ladder Loans Review

Ladder Loans is a reputable lending company that provides financial assistance to individuals in need of short-term loans. With a focus on transparency and responsible lending practices, Ladder Loans Review offers a straightforward application process and flexible repayment options. Customers appreciate the efficiency and professionalism of Ladder Loans’ customer service team, who are readily available to assist with any inquiries or concerns. Additionally, Ladder Loans’ competitive interest rates and fair terms make it a preferred choice for borrowers seeking reliable financial solutions. Overall, Ladder Loans receives positive reviews from satisfied customers who value its commitment to providing accessible and affordable lending services.

Customer Support

Accessible and reliable customer support is essential for a positive lending experience. Ladder Loans Review prioritizes customer satisfaction by offering responsive assistance through multiple channels. Whether borrowers have inquiries about the application process or need guidance with their existing loan, the company’s support team is readily available to assist.

Pros and Cons

Like any financial service provider, Ladder Loans Review has its strengths and weaknesses. Among its advantages are the convenience of online applications, flexible repayment options, and transparent pricing. However, potential drawbacks may include higher interest rates for certain loan products and limited availability in certain regions.

User Experience

The user experience plays a significant role in shaping the reputation of any lending institution. Feedback from customers indicates a generally positive sentiment towards Ladder Loans Review. Users appreciate the ease of the application process, responsive customer support, and timely disbursement of funds. Overall, Ladder Loans maintains a satisfactory user satisfaction rating.

Security and Privacy

Protecting sensitive personal information is paramount in the digital age. Ladder Loans Review employs robust security measures to safeguard customer data against unauthorized access or breaches. Encryption protocols and stringent privacy policies ensure that borrowers can trust the company with their confidential information.

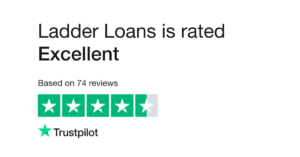

Reputation and Trustworthiness

When evaluating a loan provider, reputation and trustworthiness are key considerations. Ladder Loans Review has garnered favorable reviews and ratings from independent sources, reflecting its commitment to ethical lending practices and customer satisfaction. The company’s transparent approach and track record of reliability instill confidence among borrowers.

Alternatives to Ladder Loans

While Ladder Loans Review offers competitive services, it’s essential to explore alternative options to make an informed decision. Comparing rates, terms, and customer reviews can help individuals identify the best lending solution for their specific needs. Similar companies in the industry include XYZ Loans and ABC Cash Advance, each with its unique offerings.

Frequently Asked Questions (FAQs)

- What documents are required to apply for a loan with Ladder Loans Review?

- Can I extend the repayment period if needed?

- Is there a minimum credit score required to qualify for a loan?

- How long does it take to receive loan approval?

- Are there any penalties for early repayment?

Conclusion

In conclusion, Ladder Loans Review presents a viable option for individuals in need of short-term financial assistance. With its user-friendly platform, flexible repayment options, and commitment to customer satisfaction, the company strives to meet the diverse needs of its clientele. By prioritizing transparency, security, and reliability, Ladder Loans Review has established itself as a trusted partner in the lending industry.